gaudiumromait.site

Prices

What Is The Best Roth Ira Investment

Note: IRA contribution limits are for all IRAs combined. These amounts are adjusted for inflation and may change annually. With Roth IRAs, there are income. Although there are income limitations, some investors can receive greater tax savings and more distribution flexibility with a Roth IRA than with a Traditional. Fidelity and Wealthfront top our list of Roth IRAs that cater to self-directed and hands-off investors, respectively. Roth IRAs are a great choice for people who: · Have earned income. · Expect to be in a higher tax bracket in retirement. · Would benefit from federal tax-free. Roth IRAs let you invest for retirement today and withdraw tax-free later. Open a Roth to experience Betterment's retirement advice and technology. As such, there are two primary reasons why a Roth IRA is a great starter investment for teens and young adults: Taxes and the power of compound growth. A. The 10 best Roth IRAs · Interactive Brokers · Firstrade Roth IRA · TD Ameritrade Roth IRA · Charles Schwab Roth IRA · Fidelity Roth IRA · Merrill Edge Roth IRA · TIAA. Fidelity believes one of the best ways to do that over the long term is by considering an appropriate amount to invest in a diversified portfolio of stock. Index funds and exchange-traded funds are smart options. They offer low investment fees, portfolio diversification and a proven track record. Note: IRA contribution limits are for all IRAs combined. These amounts are adjusted for inflation and may change annually. With Roth IRAs, there are income. Although there are income limitations, some investors can receive greater tax savings and more distribution flexibility with a Roth IRA than with a Traditional. Fidelity and Wealthfront top our list of Roth IRAs that cater to self-directed and hands-off investors, respectively. Roth IRAs are a great choice for people who: · Have earned income. · Expect to be in a higher tax bracket in retirement. · Would benefit from federal tax-free. Roth IRAs let you invest for retirement today and withdraw tax-free later. Open a Roth to experience Betterment's retirement advice and technology. As such, there are two primary reasons why a Roth IRA is a great starter investment for teens and young adults: Taxes and the power of compound growth. A. The 10 best Roth IRAs · Interactive Brokers · Firstrade Roth IRA · TD Ameritrade Roth IRA · Charles Schwab Roth IRA · Fidelity Roth IRA · Merrill Edge Roth IRA · TIAA. Fidelity believes one of the best ways to do that over the long term is by considering an appropriate amount to invest in a diversified portfolio of stock. Index funds and exchange-traded funds are smart options. They offer low investment fees, portfolio diversification and a proven track record.

A Roth IRA may be for individuals with taxable compensation who want to save for retirement on a potentially tax-free basis. Why invest in a Roth IRA? Roth IRAs. A Roth Individual Retirement Account, or Roth IRA, is an investment account that helps you save for retirement and reduce taxes. Contributions and earnings. Roth IRA contribution. Can I roll my (k) into an IRA? Yes. If you have Top. Merrill A Bank of America company logo. Important notice: You are now. Savings IRAs from Bank of America and Investment IRAs from Merrill Edge® are available in both Traditional and Roth. Find the IRA that's right for you. A Roth IRA is an Individual Retirement Account to which you contribute after-tax dollars. While there are no current-year tax benefits, your contributions and. Open a Roth IRA with Merrill and give your contributions the opportunity to grow tax free through retirement. Learn how to get started investing today. Roth IRAs offer tax-free growth potential. Investment earnings are distributed tax-free when the account has been funded for more than five years and you are at. Roth IRAs are a great choice for people who: · Have earned income. · Expect to be in a higher tax bracket in retirement. · Would benefit from federal tax-free. A Roth IRA will earn you tax-free growth and offer flexibility to use your money without penalties before retirement. Roth, traditional, and spousal are 3 common types of IRAs, which you can read more about below. See Roth and traditional IRA comparison. An outline of a. A Roth IRA may be for individuals with taxable compensation who want to save for retirement on a potentially tax-free basis. Why invest in a Roth IRA? Roth IRAs. Roth IRAs are tax-free retirement savings accounts. Investments, please read the Client Relationship Summary and Regulation Best Interest Disclosure. For the tax year that's $7,, or $8, if you're age 50 or older. Get details on IRA contribution limits & deadlines. Note: IRA contribution limits are for all IRAs combined. These amounts are adjusted for inflation and may change annually. With Roth IRAs, there are income. Two popular retirement options include a Roth IRA and mutual fund investments, both of which produce a lower tax burden than a traditional (k) or pension. Roth IRAs offer tax-free growth potential. Investment earnings are distributed tax-free when the account has been funded for more than five years and you are at. Roth IRAs are tax-free retirement savings accounts. Investments, please read the Client Relationship Summary and Regulation Best Interest Disclosure. The best traditional and Roth IRAs for your retirement saving · Best overall: Charles Schwab · Best for beginner investors eager to learn: Fidelity Investments. You have many investing options to choose from when opening a Roth IRA. We've outlined some of our top choices when it comes to selecting the best investments. Roth IRAs are best for people with a long time before retirement. Many experts suggest investing IRA funds in low-cost index funds. These investments tend to.

Best Zero Apr Cards

0% Intro APR Credit Cards · Slate Edge credit card. · Slate Edge credit card · Chase Freedom Unlimited credit card. · Chase Freedom Unlimited credit card card. Read our detailed reviews of the best zero-interest credit cards and make an informed choice that will best suit your personal needs. Best 0% APR Credit Cards of August · Best in Cash Back and No Annual Fee Credit Cards. Discover it® Cash Back · Citi Rewards+® Card · Wells Fargo Reflect®. The best 0% intro APR credit cards · Wells Fargo Reflect Card: Excellent for long intro APR period · Chase Freedom Unlimited: Excellent for rewards · Wells. The Capital One Quicksilver Cash Rewards Credit Card is a card that truly offers the best of both worlds, with a long period of 0% intro APR on purchases and. 0% Intro APR Credit Cards ; Citi Simplicity® Credit Card · Low intro APRon purchases for 12 months ; Citi® Diamond Preferred® Credit Card · Low intro APRon balance. 0% Intro APR Credit Cards ; Slate Edge credit card · Save on interest with a low intro APR for 18 months ; Chase Freedom Unlimited credit card · Earn a $ bonus. 0% APR credit cards · Capital One Quicksilver Cash Rewards Credit Card · Capital One Quicksilver Cash Rewards Credit Card · Intro purchase APR · Regular. The Chase Freedom Flex's long 0% APR period, generous sign-up bonus and ongoing rewards program could net you thousands in interest savings and cash back. 0% Intro APR Credit Cards · Slate Edge credit card. · Slate Edge credit card · Chase Freedom Unlimited credit card. · Chase Freedom Unlimited credit card card. Read our detailed reviews of the best zero-interest credit cards and make an informed choice that will best suit your personal needs. Best 0% APR Credit Cards of August · Best in Cash Back and No Annual Fee Credit Cards. Discover it® Cash Back · Citi Rewards+® Card · Wells Fargo Reflect®. The best 0% intro APR credit cards · Wells Fargo Reflect Card: Excellent for long intro APR period · Chase Freedom Unlimited: Excellent for rewards · Wells. The Capital One Quicksilver Cash Rewards Credit Card is a card that truly offers the best of both worlds, with a long period of 0% intro APR on purchases and. 0% Intro APR Credit Cards ; Citi Simplicity® Credit Card · Low intro APRon purchases for 12 months ; Citi® Diamond Preferred® Credit Card · Low intro APRon balance. 0% Intro APR Credit Cards ; Slate Edge credit card · Save on interest with a low intro APR for 18 months ; Chase Freedom Unlimited credit card · Earn a $ bonus. 0% APR credit cards · Capital One Quicksilver Cash Rewards Credit Card · Capital One Quicksilver Cash Rewards Credit Card · Intro purchase APR · Regular. The Chase Freedom Flex's long 0% APR period, generous sign-up bonus and ongoing rewards program could net you thousands in interest savings and cash back.

0% Intro APR Card Offers (5) ; Blue Cash Everyday® Card. No Annual Fee · 3% cash back at U.S. supermarkets on up to $6K in purchases (then 1%) ; Blue Cash. 0% intro APR credit cards: 0% intro APR on purchases for months. Then % - % Standard Variable Purchase APR applies. Offers vary based on card. The best 0% intro APR credit cards · Wells Fargo Reflect Card: Excellent for long intro APR period · Chase Freedom Unlimited: Excellent for rewards · Wells. For a limited time, get our best rate ever: 0% intro APR* on purchases and balance transfers† for 21 billing cycles. After that, the APR is variable, currently. Best card for 0% APR on purchases for first year · e.g. Amex BCP $8, limit, May · e.g. Chase Freedom Flex $10, limit, June Read our detailed reviews of the best zero-interest credit cards and make an informed choice that will best suit your personal needs. Explore low intro rate credit cards ; 0% intro APR for 15 months; % - % variable APR after that, 0% intro APR for 15 months; % - % variable. TD Bank Credit Cards · TD FlexPay Credit Card. SPECIAL OFFER. Our best balance transfer offer: 0% intro APR for first 18 billing cycles after account opening. Best for Long Intro APR on Purchases and Balance Transfers from Wells Fargo (21 months). Wells Fargo Reflect® Card. 0% APR Credit Cards · Citi® Diamond Preferred® Card · Capital One Quicksilver Cash Rewards Credit Card · Citi Double Cash® Card · Citi Custom Cash® Card · Capital. The Ink Business Unlimited offers a generous flat rate of cash back and no annual fee. 4 min read Aug 13, woman laying on couch while working on. 8 best 0% APR and low-interest credit cards of August · Capital One VentureOne Rewards Credit Card: Best for travel · Blue Cash Preferred® Card from American. Wells Fargo Reflect Card Review: A best-in-class 0% APR promotion Photo of the Amex Everyday Preferred credit card over a pink background with abstract shapes. 0% APR business credit cards allow small business owners to make essential purchases or pay down debt over time without accumulating interest. 14 partner offers ; Wells Fargo Reflect Card · 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers · %, %, or. MoneyGeek's Take: Top 11 0% APR Credit Cards · Citi Simplicity® Card · Citi® Diamond Preferred® Card · BankAmericard® Credit Card · Chase Slate Edge℠ · Citi. MoneyGeek's Take: Top 11 0% APR Credit Cards · Citi Simplicity® Card · Citi® Diamond Preferred® Card · BankAmericard® Credit Card · Chase Slate Edge℠ · Citi. A 0% intro APR credit card from Wells Fargo allows you to use your low intro APR to help pay for unexpected expenses or big-ticket purchases. Enjoy low intro. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After the.

Pay Cash For House Or Mortgage

:max_bytes(150000):strip_icc()/dotdash-111214-buying-home-cash-vs-mortgage-v2-325bbfe3ca7343ca904ecaa9d2cb6c67.jpg)

There are often benefits to taking out a mortgage rather than paying outright with cash. The most obvious benefit is that you can purchase a. Cash out loans are nearly impossible. In order to make sure you are not doing this they will (in all likelyhood) require that you owe a legitimate bill and they. By paying cash you lose a potentially valuable tax write-off in the mortgage interest deduction. Mortgage interest may be deductible on mortgages up to $, You will also need to keep paying the mortgage on your current home until it sells. Tap into savings. In a competitive market, you may be able to justify. Yes, it's possible to get a cash-out refinance on a paid-off home. It's still called a refinance even though you won't be paying off an existing mortgage. Maybe. Advantages of Paying Cash for a Home · 1. Negotiating Power for a Lower Price · 2. No Risk of Your Deal Falling Apart From Financing · 3. No Mortgage or Rent. Pros of Paying All Cash for a Home · You're a more attractive buyer · You could get a better deal · You don't have to endure the hassle of securing a mortgage. Under Certain Circumstances You Might Pay Cash for Your House or Pay Your Current Mortgage Off · You are completely debt free without the mortgage · You want to. Yes, if you have the cash to pay for a house, you can often get a better deal. Also, you will save the costs that banks typically charge upfront. There are often benefits to taking out a mortgage rather than paying outright with cash. The most obvious benefit is that you can purchase a. Cash out loans are nearly impossible. In order to make sure you are not doing this they will (in all likelyhood) require that you owe a legitimate bill and they. By paying cash you lose a potentially valuable tax write-off in the mortgage interest deduction. Mortgage interest may be deductible on mortgages up to $, You will also need to keep paying the mortgage on your current home until it sells. Tap into savings. In a competitive market, you may be able to justify. Yes, it's possible to get a cash-out refinance on a paid-off home. It's still called a refinance even though you won't be paying off an existing mortgage. Maybe. Advantages of Paying Cash for a Home · 1. Negotiating Power for a Lower Price · 2. No Risk of Your Deal Falling Apart From Financing · 3. No Mortgage or Rent. Pros of Paying All Cash for a Home · You're a more attractive buyer · You could get a better deal · You don't have to endure the hassle of securing a mortgage. Under Certain Circumstances You Might Pay Cash for Your House or Pay Your Current Mortgage Off · You are completely debt free without the mortgage · You want to. Yes, if you have the cash to pay for a house, you can often get a better deal. Also, you will save the costs that banks typically charge upfront.

Paying all cash may allow you to close on the transaction and move into the home more quickly. People who can afford the house and have a tighter time frame may. Paying all cash may allow you to close on the transaction and move into the home more quickly. People who can afford the house and have a tighter time frame may. Ultimately, getting the best mortgage for your situation means finding the right combination of loan options while figuring out how to spread your cash among. Rental Property Fix And Flip BRRRR Wholesaling Mortgage Payment 70% Rule Airbnb Rent Estimator Rehab Estimator house in cash or using a mortgage? If we buy in. Buying a house with cash frees you from the burden of a mortgage, but it has risks as well. See what to consider before submitting an all-cash offer. Being a cash buyer means you can afford to buy a property outright, without a mortgage or loan. According to the UK House Price Index August , nearly a. While you can certainly pay cash for a house, most people need to take out a mortgage to afford a home. Financing property involves several expenses. If you can earn a better return on your investments than the interest rate on a mortgage, financing makes sense. With current low mortgage rates, you might find. Buying a house with cash has its advantages. The process can be simpler and faster because you don't need to apply for a mortgage. Your cash offer may be more. When you pay with cash, you don't have to pay certain closing costs related to mortgage loans. These can include: Loan processing fee; Loan discount points. An all-cash home purchase should be viewed as a "no-mortgage" investment. The return is the interest rate you would otherwise have paid on the mortgage but now. Benefits of Buying a Cash-Only Home · Faster sales process: Since you don't have to wait for a mortgage application to go through, you can usually close on a. No interest payments. By paying cash and not taking out mortgage debt to finance the purchase of your house, you'll avoid paying mortgage interest payments over. The Mortgage Method: · There is a monthly payment associated with this, so you must have extra cash every month to cover the principal and interest every month. Some home buying fees are the same whether you have a mortgage or make a cash offer. You'll need to submit an earnest money deposit and pay transfer taxes. Even without a mortgage loan, cash buyers must still be prepared to bring cash to closing. Pre-paid property taxes, title insurance, and escrow fees are just a. For various reasons, divorcing clients may decide to purchase a new home with cash instead of obtaining mortgage financing. New home buyers in a position to pay. You absolutely can buy a house with cash, providing you have the funds upfront to hand over to the seller. But like anything, it comes with its own advantages. Paying cash for a house can be a good way to get attention in a hot seller's market. And the idea of avoiding a monthly mortgage payment — and interest — can be. One of the primary advantages of purchasing property with cash is the elimination of interest payments. By buying a property outright, you avoid.

How To Find Your Cvv Number Without Card

The CVV Number can be found on the signature strip on the back of your card. If you use a VISA or MasterCard, you will find that the CVV printed contains a three-digit code and is located on the back of the card, near the signature area. How to recover your card's PIN or CVV number? · From the App, access the "Cards" section. · "View PIN" or "View CVV". · Enter your signature code. · You will. Your card security code (CSC), verification code (CVC), or card code verification (CCV) can be found on the back of your card and is. You can find your CVV or CVC number on your credit card. Visa - Signature strip on back of card: card number reprinted followed by your 3 digit CVV number. Visa®, Mastercard®, and Discover® cardholders: Turn your card over and look at the signature box. You should see either the entire digit credit card number. How do I find my Credit Card CVV number online? You can check the CVV number on the ICICI Bank iMobile Pay app. Log in to the app and go to 'Cards & Forex'. With most credit card networks, including Discover, Mastercard and Visa, you'll find the security code on the back of your card, to the right of the card number. If you are searching for 'how to know CVV number on debit card online', there is no way to do so. You can access your CVV only from your physical card. But in. The CVV Number can be found on the signature strip on the back of your card. If you use a VISA or MasterCard, you will find that the CVV printed contains a three-digit code and is located on the back of the card, near the signature area. How to recover your card's PIN or CVV number? · From the App, access the "Cards" section. · "View PIN" or "View CVV". · Enter your signature code. · You will. Your card security code (CSC), verification code (CVC), or card code verification (CCV) can be found on the back of your card and is. You can find your CVV or CVC number on your credit card. Visa - Signature strip on back of card: card number reprinted followed by your 3 digit CVV number. Visa®, Mastercard®, and Discover® cardholders: Turn your card over and look at the signature box. You should see either the entire digit credit card number. How do I find my Credit Card CVV number online? You can check the CVV number on the ICICI Bank iMobile Pay app. Log in to the app and go to 'Cards & Forex'. With most credit card networks, including Discover, Mastercard and Visa, you'll find the security code on the back of your card, to the right of the card number. If you are searching for 'how to know CVV number on debit card online', there is no way to do so. You can access your CVV only from your physical card. But in.

To find the virtual card number, refer to the receipt from the merchant or go to your card issuer website. If neither of these have the last 4 digits you can. Download / Log in to the Citi Mobile® App · Click on 'Manage' then 'Show' to view your credit card number and expiry date · Click on 'View' to see your temporary. Mastercard, Visa, and Discover credit cards place a three-digit CVV to the right of the signature box on the back of your card. • American Express places a four. Visa, Mastercard, and Discover card members can find their CSC or CVV2 number in the signature area of your card. Your card number should be printed here along. A CVV number helps protect your card from unauthorized purchases. · A CVV is different from a personal identification number (PIN). · To find your card's CVV. Visa® calls this code Card Verification Value (CVV); MasterCard® calls it Card Validation Code (CVC); Discover® calls it Card ID (CID). The card code is a three. One number you won't find printed or embossed on your card, is your Personal Identification Number or 'PIN'. That's the 4-digit number you enter at a payment. The CVV/CVC code (Card Verification Value/Code) is located on the back of your credit/debit card on the right side of the white signature strip;. To get started, select a participating merchant and enter the sign in credentials for your account with them, then choose the Navy Federal card you want to add. The Card Verification Value (CVV) is an extra code printed on your debit or credit card. CVV for Visa, MasterCard is the final three digits of the number. A CVV code is a three- or four-digit code (depending on your credit card company) and is also known as the security code. On Visa, Mastercard, and Discover. If you are searching for 'how to know CVV number on debit card online', there is no way to do so. You can access your CVV only from your physical card. But in. If you have an American Express Card, you will find the four-digit credit card CVV on the front. Is it safe to give out your credit card CVV code? You may. The CVV Number can be found on the signature strip on the back of your card. The Card Verification Value (CVV) is an extra code printed on your debit or credit card. CVV for Visa, MasterCard is the final three digits of the number. If you don't have your physical card, you can usually find your card number on your billing statement and digital account portal. Other options include apps. Log in to your account and go to “Manage cards” and tap the “Show card info” toggle to see your virtual card number, expiration date and CVV code. without sharing your actual card numbers. Payment card and mobile device. Widely accepted. Choose your Wells Fargo debit or credit card when you check out in. A CVV (which stands for card verification value) is a 3- or 4-digit number that appears on your credit card. The CVV is a security feature of credit cards, and. The CSC for Visa, Mastercard, and Discover credit cards is a three-digit number on the back of the card, to the right of the signature box. The CSC for American.

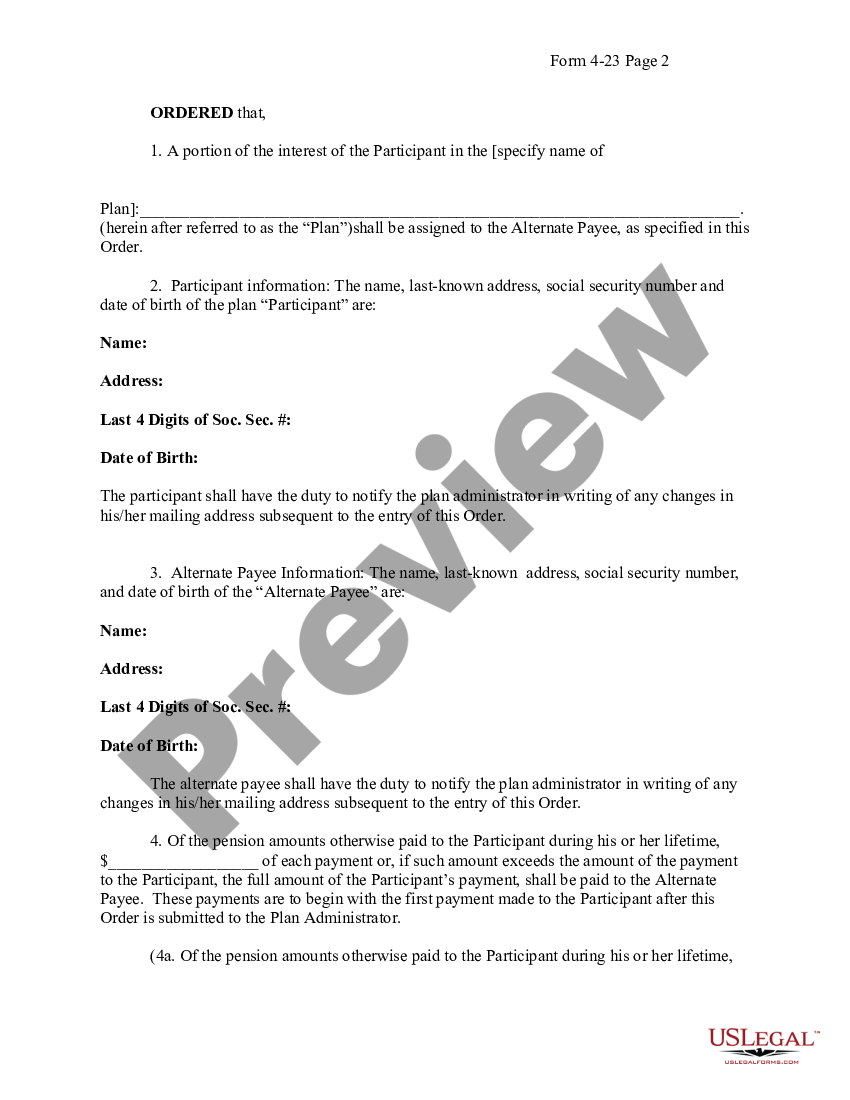

Qdro Form For Divorce

divorce proceeding to be a QDRO? . 7 form or forms to assist in the preparation of a QDRO? . In. An attorney can prepare the QDRO/DRO for you. Some pension plans have specific QDRO/DRO forms or specific language that may be required on the QDRO/DRO. A Qualified Domestic Relations Order, or QDRO, is a legal order resulting from a divorce or legal separation that gives the divorced spouse or other. A Qualified Domestic Relations Order (QDRO) is an order that assigns an Alternate Payee a portion of the pension benefits payable to a Participant of a. form is required for each contact. This form is in substitution of your divorce judgment, decree, property settlement or Qualified Domestic Relations Order. A QDRO (Qualified Domestic Relations Order) is a legal document used to divide retirement accounts in a divorce. The form is typically filed by the spouse. This Qualified Domestic Relations Order (this “Order”) is intended to meet the requirements for a “qualified domestic relations order” relating to the TEXAS. If, during a divorce proceeding, it is determined that you will keep % of your COAERS benefit, we do not need any paperwork from you. However, if it is. A QDRO is a legal order subsequent to a divorce or legal separation that splits and changes ownership of a retirement plan to give the divorced spouse his or. divorce proceeding to be a QDRO? . 7 form or forms to assist in the preparation of a QDRO? . In. An attorney can prepare the QDRO/DRO for you. Some pension plans have specific QDRO/DRO forms or specific language that may be required on the QDRO/DRO. A Qualified Domestic Relations Order, or QDRO, is a legal order resulting from a divorce or legal separation that gives the divorced spouse or other. A Qualified Domestic Relations Order (QDRO) is an order that assigns an Alternate Payee a portion of the pension benefits payable to a Participant of a. form is required for each contact. This form is in substitution of your divorce judgment, decree, property settlement or Qualified Domestic Relations Order. A QDRO (Qualified Domestic Relations Order) is a legal document used to divide retirement accounts in a divorce. The form is typically filed by the spouse. This Qualified Domestic Relations Order (this “Order”) is intended to meet the requirements for a “qualified domestic relations order” relating to the TEXAS. If, during a divorce proceeding, it is determined that you will keep % of your COAERS benefit, we do not need any paperwork from you. However, if it is. A QDRO is a legal order subsequent to a divorce or legal separation that splits and changes ownership of a retirement plan to give the divorced spouse his or.

The term QDRO (Qualified Domestic Relations Order) refers to a court order that is made under a state's domestic relations law or community property law. It. form. Authority: OPM is This will include the. Property/Marital Settlement Agreement, Divorce Decree, or Qualified Domestic Relations Order, etc. (For example: “You take the house and I'll keep my retirement benefits.”) • The QDRO form. The QDRO form provides TCDRS with the identity and addresses of the “. Form for use when one spouse wants a divorce claiming irretrievable breakdown of the marriage. Revised October Also available in Spanish and Portuguese. Must a domestic relations order be issued as part of a divorce proceeding to be a QDRO? No. A domestic relations order that provides for child support or. QDROs may be issued by a court of law to award a portion of a member's service retirement allowance, disability retirement allowance or termination refund for. WHEREAS, this QDRO is entered pursuant to the laws of the. State of Washington governing the division of marital property between spouses in divorce actions;. A qualified domestic relations order (QDRO) is a court-approved document that specifies how money in retirement accounts will be split in the event of a divorce. Press the “submit via email” button at the bottom once you have filled out the form. Alabama Pension Evaluators® Divorce QDRO Request Form (Adobe PDF Version). Qdro Form is the solution to a problem that has been faced by retirees and those who are soon to retire for many years. The process of filing for a Qdro can be. What is a QDRO? QDRO (pronounced "KWADRO") stands for Qualified Domestic Relations Order. QDROs are state court orders issued in divorce or dissolution. This Order is an integral part of the Decree of Divorce granted on. In compliance with those requirements the following is specified: 3. Alternate Payee is. TRS must also determine the DRO to be a "qualified" domestic relations order (QDRO). Approval (or qualification) of a DRO by TRS ensures that the alternate. divorce estimates. THIRD STEP: Upon receipt of the model QDRO form and the divorce estimate, an attorney (or one of the parties) should complete the form. Press the “submit via email” button at the bottom once you have filled out the form. Alabama Pension Evaluators® Divorce QDRO Request Form (Adobe PDF Version). We have provided this form [ Adobe PDF Document ] for your convenience The divorce estimate from the Division of Retirement. A model QDRO completed. This is merely a SAMPLE Qualified Domestic Relations Order that may be appropriate for use with respect to the County of Los Angeles Pension Savings Plan. The following information and forms are designed to assist members, alternate payees, and legal representatives when retirement benefits are being considered. QDRO Forms and Getting Started · QDRO - $ Each qualified retirement plan needs a separate Qualified Domestic Relations Order, although in some cases we can. A DRO is a court order issued after a final judgment of divorce that provides the ex-spouse of a member with a share of the member's benefit upon retirement.